(also known as the North Sydney Tramway and Investment Company)

The North Sydney Investment and Tramway Company (NSI&T) was an investment and property development company set up by wealthy Sydney and Melbourne personalities to profit from opening up access to land on the Middle Head peninsula.

It was created at the peak of the late 1880s property boom in NSW following a series of transactions and formation of a number of syndicates, either directly by, or following the establishment of the Cammaray Estate Land Company Ltd. which it appears to have superceded – a timeline of the transactions leading up to its formation and subsequuent decline is provided here.

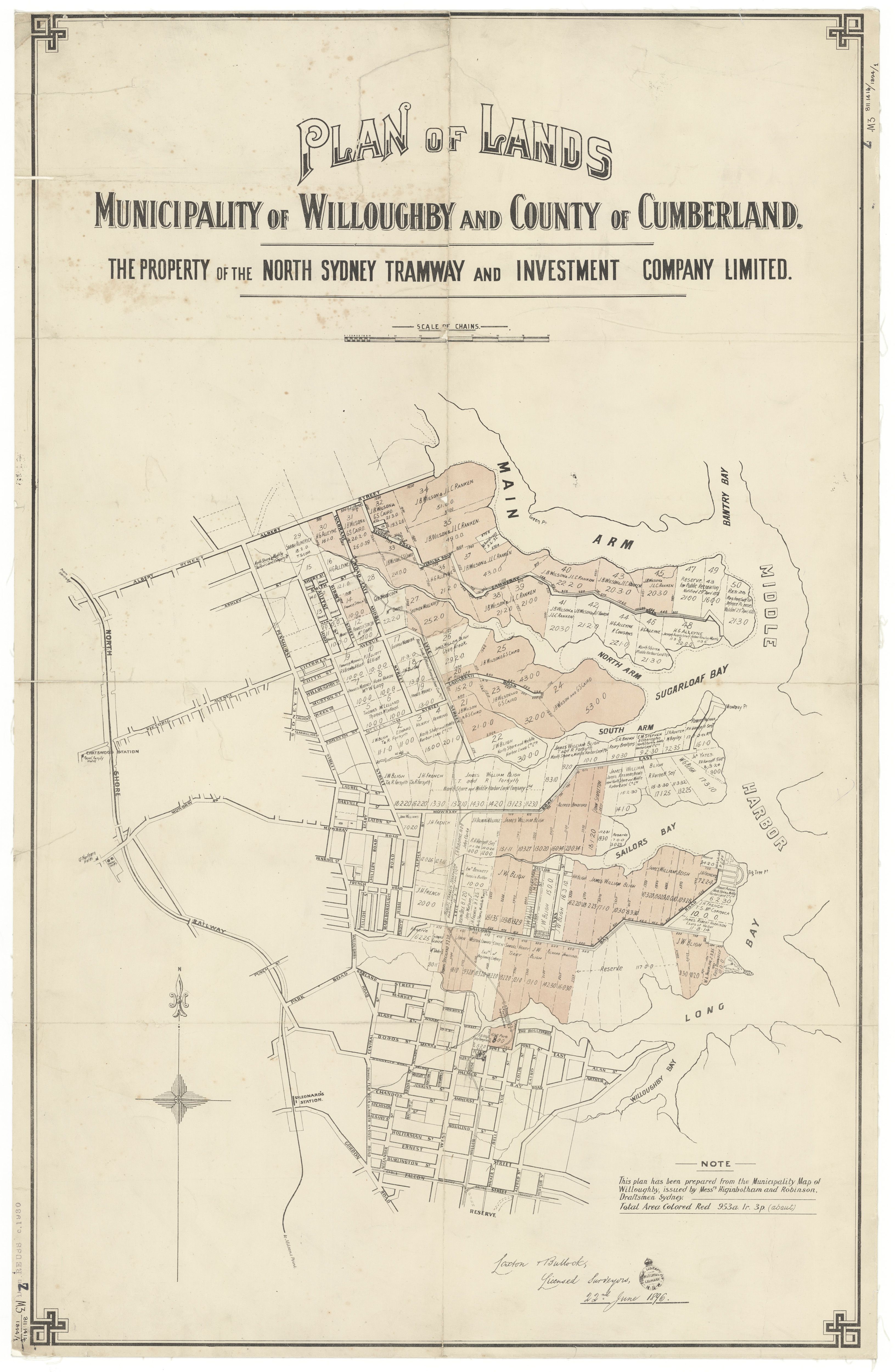

A primary goal of the Company was to provide Tramway access to ~600 acres of undeveloped land on the ‘middle harbour peninsulas ‘to the north of the Flat Rock Creek’ that the Cammaray Estate Land Company had the rights to. These areas are now better known as Northbridge, Castlecrag, and Castlecove.

Their plan was to build a bridge across Long Gully and run a tram line from the St Leonards Government tramway in Miller Street near Ridge Street, across the suspension bridge to what is now Castle Cove, and to extend this to a branch line into the Castlecrag Peninsula, terminating near the present 203 bus Terminus.

The key player in this was a Charles. A.M. Leake who had secured the rights to the land on the 16 March 1888 by entering into an agreement with 2 individuals to acquire a total of 1,004 acres of land in ‘North Sydney’ for a total of £175,400, and then swiftly worked to create a syndicate to purchase this property from him for £200,000. It appears that investors in Melbourne then got wind of the opportunity and a further (expanded) syndicate was formed to purchase the 1,004 acres for £300,000.

The company raised capital through debentures which had a schedule of returns to investors.

These debentures were effectively a loan from an investor to the company with the expectation that the returns (interest payments) to investors should be paid out of the profits derived from their investments, in this case, sale of small blocks of land, then owned by the Company, on the northern side Long Gully.

There was still demand so further shares were created bringing the total investment by shareholders in the land to £500,000 “.. and the price of the land was Increased accordingly” (Daily Telegraph, 1 March 1899, page 7).

With all this done, the NSI&T Co. was registered with a capital of £500,000 to “.. carry out its intended policy of the construction of a bridge across an arm of Middle Harbour to give access to the estate, and build a tramway from the present terminus of the North Shore tramway”.

Unfortunately, there were delays in the construction of the bridge and the early impacts of the impending depression were starting to bite so the Company needed more cash. With that purpose, they went to the London market to raise a further £300,000 through debentures.

It seems that this was a very attractive investment proposition as it was reported to be over-subscribed during the early debenture offers. On the periphery of this was J.W. Cliff who acted as agent/trustee for the investment, and through this, became tangled up in the failure of the company in the early 1890s in the midst of the ‘greatest depression the Colony has ever had’.

A timeline of its formation and eventual demise is provided here.