The 1880s property boom was financed by rapid expansion in bank lending. In addition, many building societies and property finance companies, known as ‘land banks’, sprang up during the 1880s. The increased competition from such new entrants weakened banks’ prudential standards (Merrett 1989). While some recognition of this came in 1888, when the Associated Banks increased interest

rates and adopted stricter capital standards, for many financial institutions the damage already done was too severe to be repaired (Boehm 1971).The collapse in property prices in 1889 led to a spate of building society failures in 1890. As it became clearer that the fall in property prices was not just a temporary fluctuation, the financial collapse spread to the land banks. As the number of failures and frauds grew, public confidence in financial institutions faltered,

spreading the crisis to the institutions at the core of the financial system – banks that issued their own bank notes.Counting banks as any institution that called itself a bank and solicited public deposits, 54 of the 64 institutions operating in 1891 had closed by mid 1893; 34 of these closed permanently.

A history of last resort lending and other support for troubled financial institutions in Australia (Bryan Fitz-Gibbon and Marianne Gizycki, RBA, October 2001)

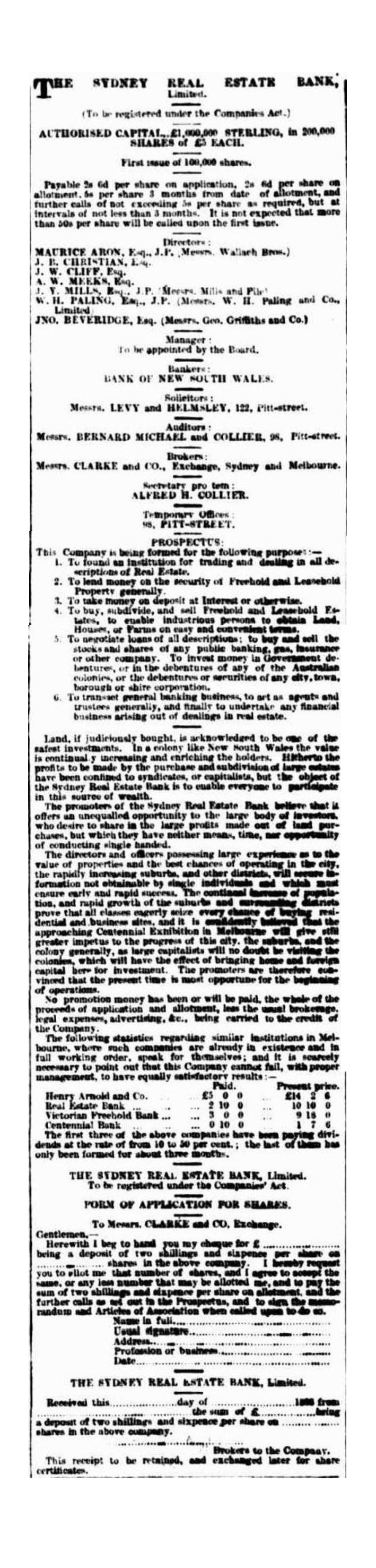

J.W. Cliff was one of several leading figures in NSW in the 1880s who established The Sydney Real Estate Bank in 1888.

The others were

- Mr. M. (Maurice) Aron, Esq. J.P., a partner in the firm Messrs. Wallach Bros., a prominent furniture warehouse that in 1888 had 2 five storied buildings in York St., Wynyard Square.

- Mr. J. B. Christian

- Mr. J. W. Cliff

- Mr. A. W. Meeks, who was the recipient of a ‘Complimentary Luncheon’ held on April 12, 1888, attended by “..members of the legislature, leading commercial and financial men, civic representatives, members of the legal profession, and the proprietors of the Adelaide dailies” [South Australian Register, Friday 13 April 1888, Trove). He had been in Adelaide for 5 years “.. for the purpose of establishing a branch of the great mercantile house with which he was connected..”, he appears to have also been on the Board of a local bank. During his time there he also had served as the “Premier of the Commercial Pariament of South Australia, or, in other words, the Chamber of Commerce.” etc.

- Mr. J. Y. Mills, who was a member of the firm of Mills and Pile, which closed in 1889. J.Y. Mills became insolvent in 1891. The firm appears to have been a property trading firm that held significant assets prior to its closure and his insolvency

- Mr. W. H. Paling of the musical instruments firm, who survived the property collapse; and

- Mr. John Beveridge, J.P., of George Griffiths and Co. a wholesale grocery and general merchandise, in the Centennial Buildings, Bridge St. Sydney